Fidelity Retirement is one of the most trusted names in the financial services industry, offering a wide range of retirement planning solutions to help individuals achieve their long-term financial goals. Whether you're just starting your career or nearing retirement age, understanding how Fidelity's retirement plans work can make a significant difference in securing your financial future. In this article, we will explore everything you need to know about Fidelity Retirement, including its services, benefits, and strategies to maximize your savings.

Fidelity Investments, founded in 1946, has grown into a global leader in financial services, providing investment management, retirement planning, and wealth management solutions. With over $12 trillion in assets under administration, Fidelity is trusted by millions of individuals and institutions worldwide. Their retirement offerings are designed to cater to diverse financial needs, making them a popular choice for those seeking to build a secure retirement portfolio.

This guide aims to provide a comprehensive overview of Fidelity Retirement, ensuring you have all the information necessary to make informed decisions about your financial future. Whether you're exploring 401(k) plans, IRAs, or other retirement savings options, this article will walk you through the key features, benefits, and strategies to optimize your retirement savings with Fidelity.

Read also:Is Mackenyu Married Exploring The Personal Life Of The Rising Japanese Star

Table of Contents

- Introduction to Fidelity Retirement

- History of Fidelity Investments

- Retirement Options Offered by Fidelity

- IRA Plans and Their Benefits

- Understanding 401(k) Plans

- Roth IRA vs Traditional IRA

- Effective Investment Strategies for Retirement

- Tax Advantages of Fidelity Retirement Plans

- Fidelity Retirement Fee Structure

- Customer Support and Resources

Introduction to Fidelity Retirement

Fidelity Retirement offers a suite of financial products designed to help individuals save for their retirement years. With a focus on long-term growth and financial security, Fidelity provides tools and resources to assist in planning and managing retirement funds effectively. Their comprehensive approach ensures that individuals can tailor their retirement plans to suit their specific financial goals and risk tolerance levels.

One of the key advantages of Fidelity Retirement is its user-friendly platforms and educational resources, which empower individuals to make informed decisions about their retirement savings. Whether you're a beginner or an experienced investor, Fidelity's offerings cater to a wide range of financial literacy levels.

Why Choose Fidelity for Retirement Planning?

- Wide range of investment options

- Competitive fee structure

- Robust online tools and resources

- Exceptional customer support

History of Fidelity Investments

Founded in 1946 by Edward C. Johnson II, Fidelity Investments began as a small mutual fund company. Over the decades, it has grown into one of the largest financial services firms in the world, offering a diverse array of products and services. Fidelity's commitment to innovation and customer service has been instrumental in its success, making it a trusted name in the financial industry.

The company's expansion into retirement planning and wealth management has solidified its position as a leader in these fields. Today, Fidelity serves millions of customers globally, managing trillions of dollars in assets. Its dedication to providing high-quality financial solutions has earned it a reputation for reliability and trustworthiness.

Retirement Options Offered by Fidelity

Fidelity offers a variety of retirement plans to suit different financial needs and goals. From traditional IRAs to Roth IRAs and employer-sponsored 401(k) plans, Fidelity's offerings provide flexibility and customization for retirement savings.

Key Retirement Options

- Individual Retirement Accounts (IRAs)

- 401(k) Plans

- Roth IRAs

- SEP IRAs for Self-Employed Individuals

IRA Plans and Their Benefits

IRA plans are a popular choice for individuals seeking to save for retirement outside of employer-sponsored plans. Fidelity offers both Traditional and Roth IRAs, each with its own set of benefits and features.

Read also:James Harden Yes King Video Original The Untold Story

Benefits of IRA Plans

IRA plans offer several advantages, including tax-deferred growth, flexibility in investment choices, and the ability to contribute even if you participate in an employer-sponsored plan.

Key Features

- Tax-deferred or tax-free growth

- Wide range of investment options

- Contribution limits aligned with IRS regulations

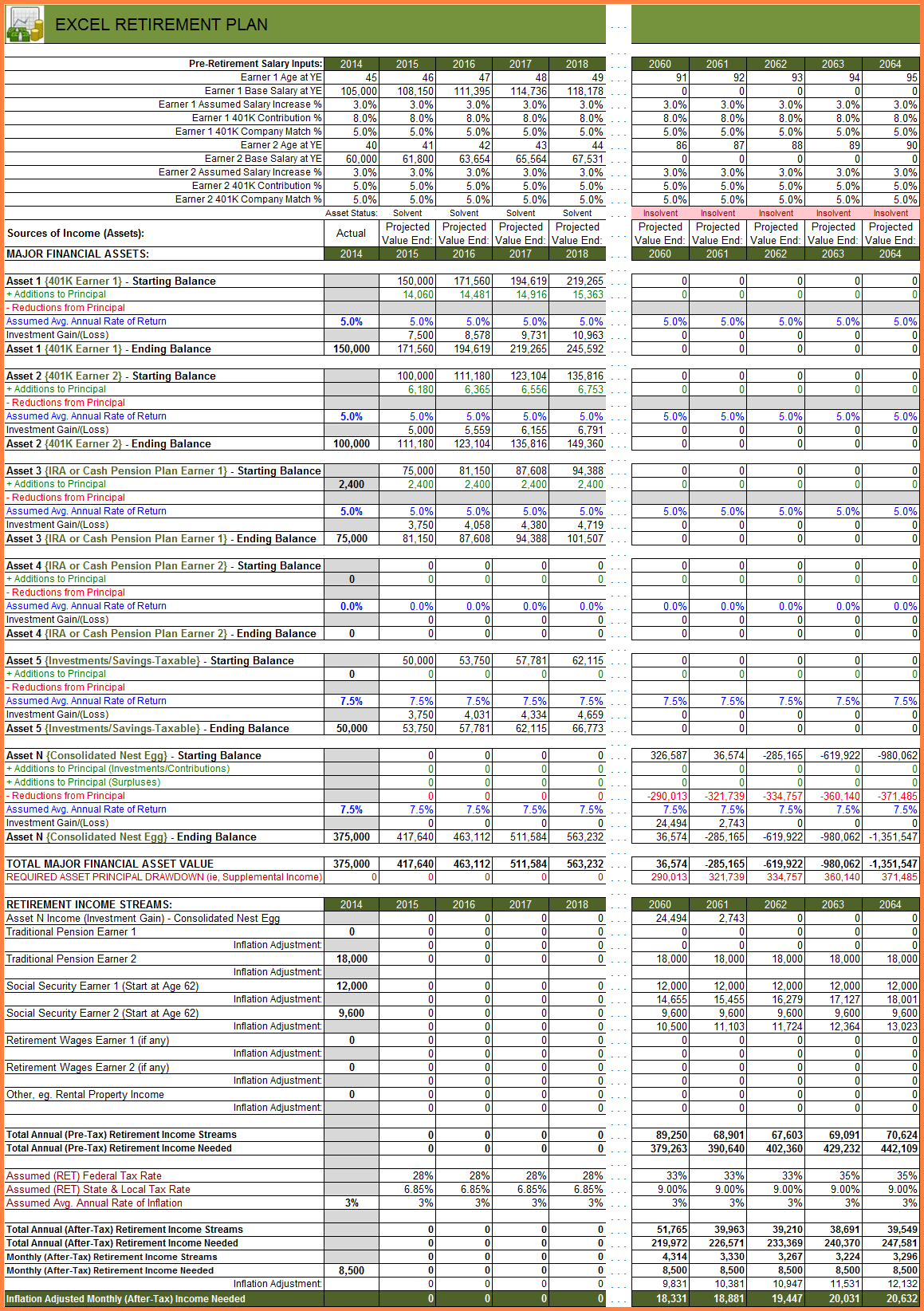

Understanding 401(k) Plans

A 401(k) plan is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their salary on a pre-tax basis. Fidelity offers robust 401(k) solutions that include investment management, administrative services, and educational resources to help employees maximize their retirement savings.

Advantages of 401(k) Plans

- Employer matching contributions

- Tax-deferred growth

- Automatic payroll deductions for convenience

Roth IRA vs Traditional IRA

Choosing between a Roth IRA and a Traditional IRA depends on your financial situation and retirement goals. Both options offer tax advantages, but they differ in how and when those benefits are realized.

Roth IRA

Roth IRAs are funded with after-tax dollars, meaning withdrawals in retirement are tax-free. This can be advantageous for individuals expecting to be in a higher tax bracket during retirement.

Traditional IRA

Traditional IRAs offer tax-deferred growth, allowing contributions to be made on a pre-tax basis. Withdrawals in retirement are taxed as ordinary income.

Effective Investment Strategies for Retirement

Maximizing your retirement savings requires a well-thought-out investment strategy. Fidelity provides tools and resources to help you create a diversified portfolio aligned with your risk tolerance and financial goals.

Key Strategies

- Diversification across asset classes

- Regular portfolio rebalancing

- Long-term investment horizon

Tax Advantages of Fidelity Retirement Plans

Fidelity Retirement plans offer significant tax advantages that can enhance your savings over time. Understanding these benefits can help you make the most of your retirement contributions.

Tax-Deferred Growth

Both Traditional IRAs and 401(k) plans allow for tax-deferred growth, meaning your investments grow without being taxed until withdrawal.

Tax-Free Withdrawals

Roth IRAs offer tax-free withdrawals in retirement, provided certain conditions are met. This can be particularly beneficial for individuals expecting higher tax rates in the future.

Fidelity Retirement Fee Structure

Fidelity is known for its competitive fee structure, making it an attractive option for retirement savers. Understanding the fees associated with your retirement plan is crucial for maximizing your savings.

Common Fees

- Account maintenance fees

- Investment management fees

- Transaction fees

Customer Support and Resources

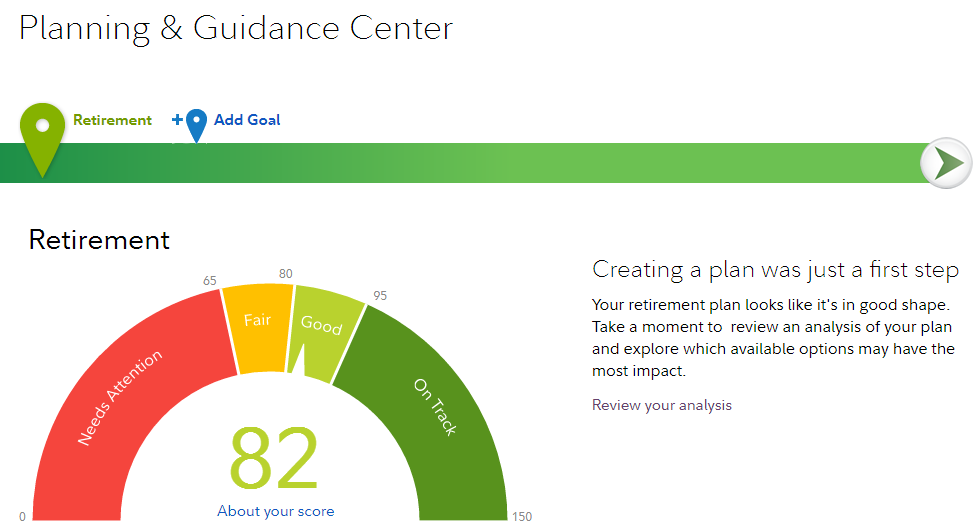

Fidelity offers exceptional customer support and educational resources to assist individuals in managing their retirement savings. From online tools to personalized advice, Fidelity ensures that customers have the support they need to achieve their financial goals.

Resources Available

- Online calculators and planning tools

- Personalized investment advice

- Comprehensive educational materials

Kesimpulan

Fidelity Retirement provides a comprehensive suite of financial products and services designed to help individuals secure their financial future. By offering a wide range of retirement plans, competitive fee structures, and robust customer support, Fidelity has established itself as a trusted leader in the financial services industry.

We encourage you to take advantage of the tools and resources provided by Fidelity to create a retirement plan that aligns with your financial goals. Whether you're exploring IRAs, 401(k) plans, or other retirement savings options, Fidelity's offerings can help you build a secure financial future.

Don't forget to leave a comment or share this article with others who may benefit from the information provided. For more insights on financial planning and retirement strategies, explore our other articles on the site.